×

![]()

With their Notice of Proposed Rulemaking this past summer, the federal agencies intensified the debate over an appropriate change, if any, in the appraisal exemption

level as identified in the Interagency Appraisal and Evaluation Guidelines. The agencies proposed an increase in the current de minimus level, locked in at $250,000 for over 20 years,

to $400,000 to provide commercial banks more flexibility in using commercial evaluations in lieu of appraisals with the primary intent to produce regulatory relief.

The fulcrum of this initiative is the small balance commercial lending space that, according to our proprietary research, generated loan volume in excess of $200 billion in 2017

involving commercial and multifamily mortgages under $5 million in value.

Because of Boxwood’s pre-eminent focus on this small commercial property and loan space, we surveyed our clients this past November about their reactions to and outlook for the proposed

rule change.

As we discuss in our recent narrative report, Boxwood’s survey of commercial bank appraisers and credit officers generally confirmed the agencies’ primary assertion that

the higher threshold exemption will lower costs for financial institutions. Yet our finding of predominantly moderate increases in commercial evaluations will probably yield

less robust financial benefits than the agencies projected. Here is a synopsis of the report’s findings:

- Nearly two-thirds of bank officers support the new rulemaking. Among those that supported the threshold increase, an overwhelming majority claim that their financial

institution will see an upturn in small balance lending (SBL) volume and borrowers will also save on costs.

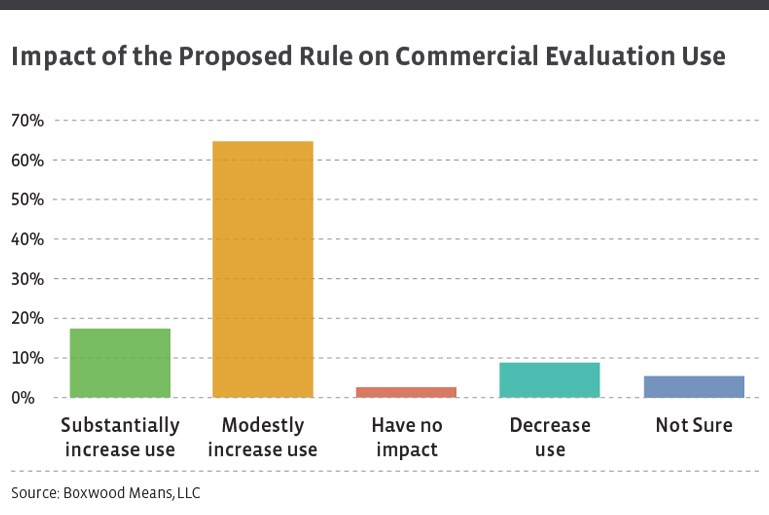

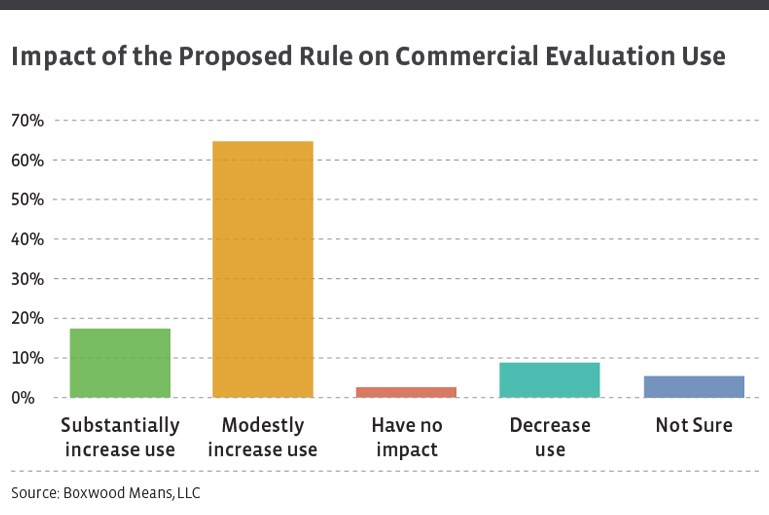

- Over 80% of respondents will increase use of commercial evaluations. However, most bank officers expect to see only a modest rise in evaluations use, not an upsurge.

- A diversity of opinion prevails on using commercial evaluations on larger loan renewals. Almost half of the participants were comfortable employing evaluations on

loan renewals and extensions amounting to $1 million or more involving a property with relatively low credit risk. But a sizable minority indicated they will play

it more conservatively on loan renewals by restricting evaluation use at either the existing or proposed exemption level.

- Bankers project modest internal cost savings from the new rule. A majority anticipates some cost savings by replacing appraisals with commercial evaluations, but

only a slim minority expect substantial savings to accrue.

This latter finding runs afoul of the agencies’ expectations for “significant” cost savings by financial institutions. To be fair though, the agencies considered other factors

like time savings in calculating their assessment of the level of potential cost reductions.

Boxwood’s own assessment is that the promise of regulatory relief may be best achieved – and, importantly, on a recurring basis at that – if more financial institutions prudently relax

restraints on commercial evaluation use with larger-sized renewal loans.

Download or register for Boxwood full report here